The Rate Schedules allow for the configuration of different Rate Sets of pay that may be applied to employees if they either work over a period of industry hours or if an employee's age increase is reflected in a higher pay rate bracket. The Rates Manager also allows the configuration of Special Rates and roles for particular jobs, which can pay at a rate different from the employee's base rate. It is also possible to establish rules which apply to the configured roles and allow control over how they are paid.

Items included in this article include;

- How to Access

- Defining rates

- Ratesets values

- Linking Ratesets to employees

- Rates increases during payroll

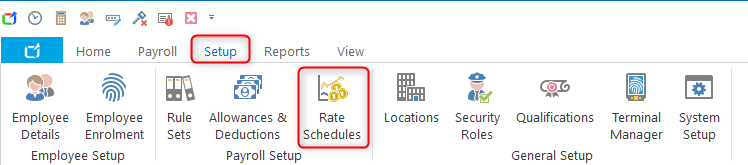

How to Access

- Navigate to Setup > Rate Schedules.

The Administrator can add, edit, duplicate, apply or delete Rate Sets:

Select the Add button to create a new Rate Set (this may later be applied to individuals or groups of employees). The Rate Set may be based on age, industry hours worked, years worked or simply contain a list of Special Rates to be applied when rostering or editing time sheets.

- Select the Edit button to modify the details of an existing Rate Set.

- Select the Duplicate button to create an exact copy of the selected Rate Set. You must enter a new name when prompted.

- Select the Apply button to link the selected Rate Set to one or more employees.

- Select the Delete button to permanently remove the selected Rate Set from the listing. This operation will not succeed if one or more employees are linked to the selected Rate Set.

Defining rates

The next step is to define the conditions around the rates for the Rateset. To do this open the Rateset by either double-clicking on it or selecting it and clicking the Edit button.

Once open you will see the following screen

From here we can define the rates. First, choose how you would like the rates to be increment by

- Age Based - the rate is incremented in the payroll that the employee has a Birthday.

- Industry Hours - Hours worked in ClockOn, can be manually set initially on the employee's profile under the Categories / Dates tab and will increment automatically as the employee is processed through payrolls.

- Years Worked - Incremented in the payroll when the employee passes their employment year as per their employee start date set on the employee's profile under the Categories / Dates tab.

Assuming that we are using the Age Based method we can set this up by using the add button and then setting the age brackets into the screen, you can add as many of these as is needed, but note that the first one will be the leading up to, and the last will be for thereafter.

You will now need to enter the $ rates that you wish to use for the Rateset, simply enter this into the relevant Years of Age fields

Ratesets values

We recommend getting advice from your governing body or award for the current minimum payments for your industry. A useful method of retrieving award information on this is to use the Fairwork Award listing via the following link https://www.fairwork.gov.au/awards-and-agreements/awards/list-of-awards

Below is an example of how you can use this to determine the correct rates.

Pharmacy Industry Award 2020

https://awardviewer.fwo.gov.au/award/show/MA000012

Locate the Minimum rates table within this article that details what the rates are for each level of work.

Scroll down to the junior rates section of this article fro the age bracket percentages.

From there it is a conversion of the percentage for the full rate based on the percentage provided,

We will use the Pharmacy Assistant Level 1 in this example

45% for under 16 year old employees (22.33 x 0.45 = 10.0485)

50% for 16 year old employees (22.33 x 0.5 = 11.165)

60% for 17 year old employees (22.33 x 0.6 = 13.398)

70% for 18 year old employees (22.33 x 0.7 = 15.631)

80% for 19 year old employees (22.33 x 0.8 = 17.864)

90% for 20 year old employees (22.33 x 0.9 = 20.097)

With these figures we can enter them into the rateset as below

Linking Ratesets to employees

Once the Rateset has been set up then it needs to be linked to the relevant employees, this is done on the employee's profile under the Pay tab. For a guide on how to do this please see the Pay Tab - Applying Rate Sets to an Employee.

Rates increases during payroll

Once the employee is attached to Rateset and if their current hourly rate is below the minimum defined in the Rateset then you will be prompted at the start of payroll as to if you would like to correct this

To apply the new rate simply click the employee's name and use the Update button to make the correction. The payroll will then use this new rate and the employee's hourly rate will be updated on their profile once the payroll has been completed.

For more information please see our Step 3 - Updating Employee Pay Rates guide.