The following guide details options within the system for adjusting the rate of super accruals as well as how to process additional payments or corrections in the system.

The following topics are covered in this article;

- Setting the super percentages for payroll.

- Manually pay an additional amount of super within a single payroll.

- Making a correction for missed super (with corrections to the OTE balances).

- Pay an additional percentage amount per payroll as an Additional Super Contribution.

- Paying an additional super amount as a set amount.

- Set up an Employee's Super Salary Sacrifice Allowance.

- Set up an Employee's Super Co-Contribution Allowance.

- Super payments to Directors.

Setting the super percentages for payroll.

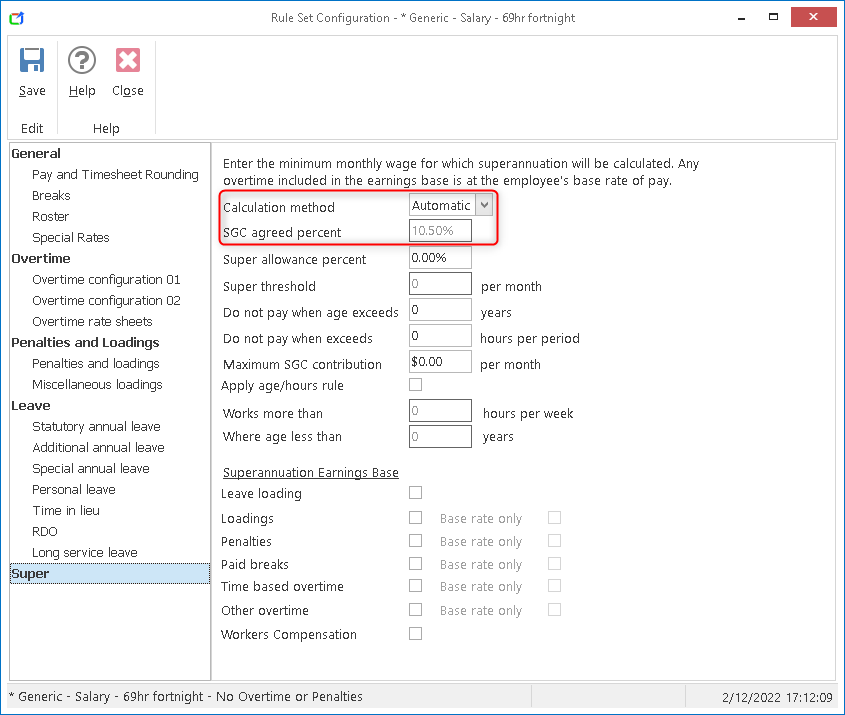

ClockOn will automatically set the percentages for the super calculation residing within the Rule Sets view under the Super option, this is based on the payment date set against the payroll. You can override this percentage by changing the calculation to Manual if you would like to pay this at a higher rate.

The following article provides additional detail as to how to access and change the super settings

Superannuation Contribution Adjustments (Rule Sets)

Manually pay an additional amount of super within a single payroll.

You may have a requirement to backpay or reduce an employee's super as a one-off correction to the super amount.

To do this generate payroll and add the amount to the employee's existing Employer Contribution amount.

Making a correction for missed super (with corrections to the OTE balances).

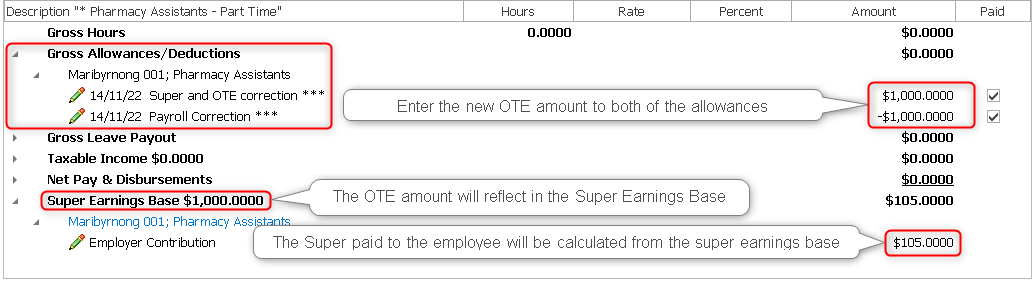

You may have an instance where some super from previous periods were missed and you need to add them to the system, an example of this is that you may have processed an allowance but forgot to include it in your super earnings base.

You can do these corrections by using the below allowances.

- Add a before-tax allowance, ensuring that the option to Include in the super earnings base is enabled.

This will work to add the indicated amount to the employee's OTE and calculate the super within the payroll.

- Add a before-tax deduction, this will negate the amount entered in the above allowance to prevent an overpayment

This amount needs to not be included in the super earnings base.

Pay an additional percentage amount per payroll as an Additional Super Contribution.

ClockOn provides the option for employers to contribute an additional percentage of super into the employee's super funds automatically on a per payroll bases, to set this up follow the steps below

- Open the Ruleset that the employee is attached to and select the Super side panel item

- Set the calculation method to Manual, then adjust the SGC agreed percent to equal the total agreed amount to the employee.

In the example above the employee has an agreed 12%.

This will pay the employee the full 12% at payroll and for super reporting purposes split the difference from the standard SGC rate and the additional % as an Additional Super Contribution to ensure that the total to the full 12%.

Paying an additional RSEC super amount as a set amount.

Open the employee's allowance screen and add a new allowance

- Set the Name field to an appropriate value as this will be how it will appear within payroll and on the employee's payslip.

- Set the "Process As" value to "YTD Super RSEC Additional"

- Set the amount and per period settings (Note leaving this setting at $0 will require you to manually enter this directly into the payroll run)

Once the allowance has been added you will see it listed as a line within the Net Allowances / Deductions section on the payroll.

In addition to this, you will also need to manually adjust the amount of super listed in the super section Employer Contribution record by the same amount.

Set up an Employee's Super Salary Sacrifice Allowance.

Please refer to the Setup of Super Salary Sacrifice article.

Set up an Employee's Super Co-Contribution Allowance.

Please refer to the Setting up Super Co Contribution article.

Super payments to Directors.

Super payments to directors can be split into two categories

- SGC that the employer has delayed till EOFY for financial reasons.

- Director Fee bonus payments that have elected to sacrifice to super.

SGC payments

Based on the information provided by the ATO, (https://www.ato.gov.au/Business/super-for-employers/work-out-if-you-have-to-pay-super/) directors are due SGC super contributions in the same way as a standard employee.

Users will need to ensure that this amount has been assigned to the employee prior to the final submission for the financial year, if you have elected to retain this amount up until this point then you will need to pay this using the instructions within the Manually increase the amount of SGC super within a single payroll. instructions.

Bonus Payments

As it is not uncommon for Directors to receive a bonus amount per year, some elect to put that amount directly into their super funds as a salary sacrifice amount rather than receive the funds directly rather than incurring additional tax.

To set this up follow the steps below

- Create a Before-Tax Allowance, and set the PAYG Location to Directors Fees Allowance

- Create a Super Salary Sacrifice Allowance and set the options as per below

- Enter the amounts for the allowance on the payrolls screen to process the amounts

(The above example shows a director's fee of $50 or which is then allocated directly to super via a salary sacrifice.)

(The above example shows a director's fee of $50 or which is then allocated directly to super via a salary sacrifice.)

By setting the allowances up this way the end result is that the entire amount of the bonus allowance will be allocated to the Super Salary Sacrifice amount.